Revisiting Nintendo

What happened since I posted my investment thesis

First of all, I wish you all a Merry Christmas and a Happy New Year! I hope you had a good year of learning in 2025. More learning awaits you in 2026. I won’t be writing an annual review this year, but so far I feel more humble than ever about what I know (and also about what I don’t know). I am very happy with my current portfolio, and my biggest goal for 2026 is to strive to continue learning and integrate AI into my investment process. I don’t believe AI will make decisions for me, but it will allow me to more easily track existing positions and watchlists. However, in a world dominated by computers and algorithms, there is more alpha than ever for those willing to dig deeper into opportunities that are not immediately visible in filters. I believe my positions in Nintendo and John Deere fit this idea.

I published in March 2024 my view on the Nintendo’s investment thesis. Since this post, the stock price is +10% but this is because the price is under pressure with a -31% drawdown from ATGH in latest August 2025. At this date, the stock price was 61% up comparing it with the stock price from 2nd March 2024. Beyond stock price, the performance of the business have been as good as I expected. Nintendo launched Nintendo Switch 2 (SW2 going forward) and it seems this new console is on track to repeat the same success as SW1. Let’s talk on the relevant events which had happened and which events matters going forward.

I leave you below my original investment thesis. I posted it in Spanish but feel free to translate it using the browser. I believe it's the best post I published so far in this project.

The thesis was right

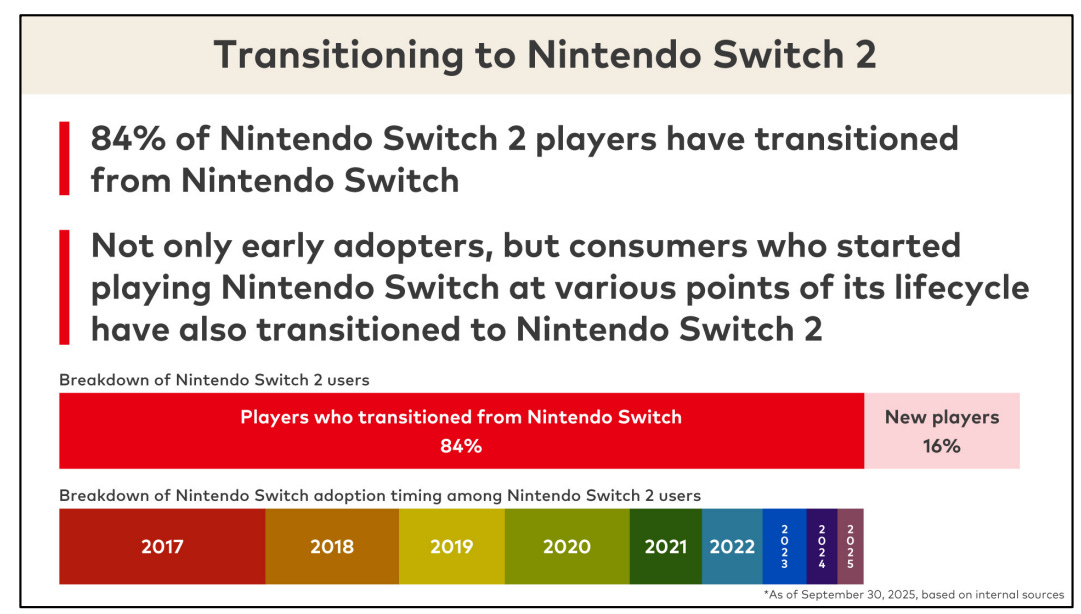

The main point in the investment thesis was a bet on releasing a new hardware backward compatible with SW1. Well, the management did not miss the opportunity this time and SW2 is everything a shareholder was asking for. Players can enjoy a better hardware with SW2 and those who are still playing at SW1 can enjoy the new software. The key point here is Nintendo is maximizing its whole customer pool for a low CAC for first time ever. Also, the adoption of the new system have been marvelous:

The company is improving structurally as SW2 is:

The fastest-selling Nintendo hardware EVER. Around 10.36 million units of SW2 have been sold within the first 6 months. SW2 has surpassed Wii, which it sold 5.84 million units in the same period. We´re talking SW2 has sold almost 6 million units more than SW1.

In the software side, multiple hit titles have emerged early in its lifecycle. Also, Nintendo will probably launch refreshing content eventually for the early games launched in 2025, such as DLCs, to improve the activity of those names. At the end, for a small amount of CAC, Nintendo will gain higher ARPU. In addition, Nintendo is the best company creating games around its IP, therefore we can expect strong activity going forward.

The environment flywheel is getting stronger as 3P support is the most extensive of any Nintendo platform. Besides that, the erosion of Sony and Xbox will derive in more parties interested in launching games in SW2.

All the points mentioned benefits Nintendo allowing a smooth transition of the customers into the new system.

What is still misunderstood about Nintendo

Taking in account the current drawdown, I believe there is still alpha to those who did the work on Nintendo and understand the key moat of the company: its IP.

The recent drop in share prices is due to the increase in the cost of key hardware components, such as RAM and flash memory. I have not found any official data reflecting the price of both components, but according to available sources, the cost of RAM has skyrocketed by 41% in this quarter alone. Again, there is no official information, but based on the previous hardware cycle, Nintendo sells hardware at no profit margin or with a very small margin. Therefore, if the price of the raw materials needed for the hardware increases significantly, the margin will be drastically affected. I think we can assume that the new hardware units will be sold at a negative margin if Nintendo does not raise the prices of SW2 next year. Do I think this is likely? Coming from Nintendo, I highly doubt they will. They raised the price of SW2 hardware compared to the retail price of SW1, and we saw a lot of people complaining about it on social media.

Nintendo has the pricing power to raise SW2 price but the key question here, should they do so? To be honest, I believe it’s better not to raise prices in order to sell as many units as possible and gain profitability from the software side. Nintendo will never make significant money from the hardware side, so they should push the software and subscription side as much as possible. It’s very important to push the maximum stock available to the consumers during this Christmas and monetize it during 2026 through their best asset: the IP.

Nintendo counts with 128 million of annual playing users, 400 millions of Nintendo Accounts and 34 millions of Nintendo Switch Online Members. Taking in account the massive customer base, the pipeline of 1P games available (plus those incoming next year) and the strong support of 3P titles, I believe Nintendo should minimize short term profits selling the hardware at negative profit is necessary in order to maximize long term gains thanks to its entertainment flywheel.

Lastly, another underrated side of Nintendo is its movie side. In 2026 they will publish a new Mario movie called The Super Mario Galaxy Movie and a live action movie of The Legend of Zelda planned to be release in 2027. Whenever they release a movie, all this benefits are taking place:

Higher revenue in this side of the business.

Higher volume of hardware units sold thanks to the marketing of the movie. In the long term, Nintendo will gain higher margin software sales from those units.

Less marketing expenditure is required, as word of mouth about the film will take care of that. In the months following the release of Mario Bros Movie, marketing expenditure as a percentage of revenue decreased. This allows for greater profitability and free cash flow conversion, as marketing expenditure is one of the key costs in the company’s income statement..

Nintendo extends its IP to new generations through the movie. Afterwards they might monetize it.

More merchandising and licensing revenue.

Nintendo is very involved in the production of those movies as they want to control and limit what it’s shown in order to preserve the attractiveness of the IP. Nintendo should study Disney and avoid what they did in the last decade. Summing-up, movies are a great new point of touch for existing and potential new customer with Nintendo’s IP.

Final thoughts

I consider myself a long term investor so I should be capable of going things through even in a cloudy day. In order to obtain a decent return investing everyone should take some decisions against the market consensus and hold positions under temporary issues. I believe Nintendo will succeed in the long term therefore I’m increasing my position.

Please remind this is not an investment advice. You should do your own due diligence before investing.