Secure Waste

Trash means cash

Investment thesis

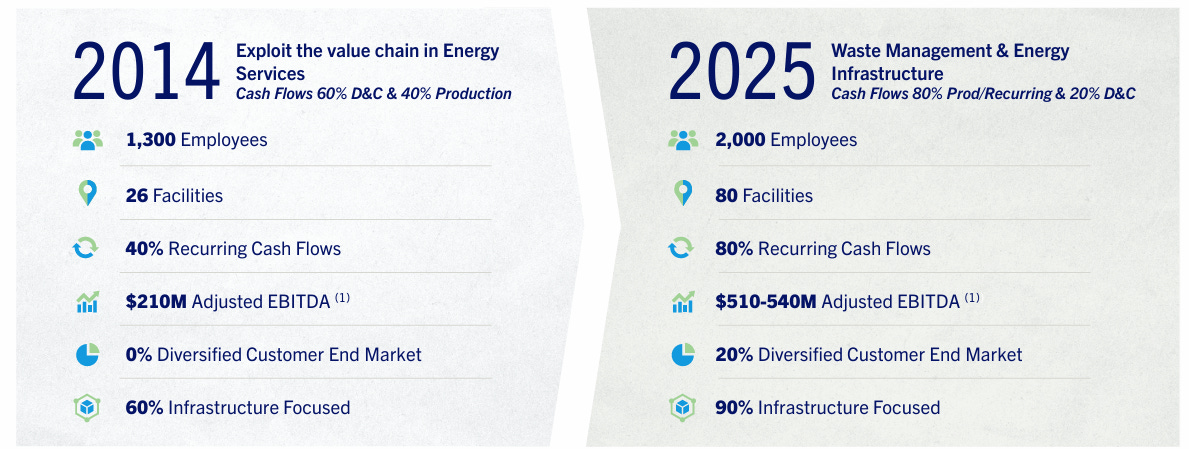

The investment thesis in this company is: a strong management team (very savvy in capital allocation) that have increased the recurring cash flows of the business moving towards waste management operations. 90% of the business is infrastructure focused, lowering the risk of booming demand through the business cycle.

Why is there an opportunity here?

The company has gone from being an energy company, barely profitable, to a company entirely dedicated to waste management. Profitability is very high (EBITDA margins above 30%), but this is hidden behind misleading accounting.

Growth drivers

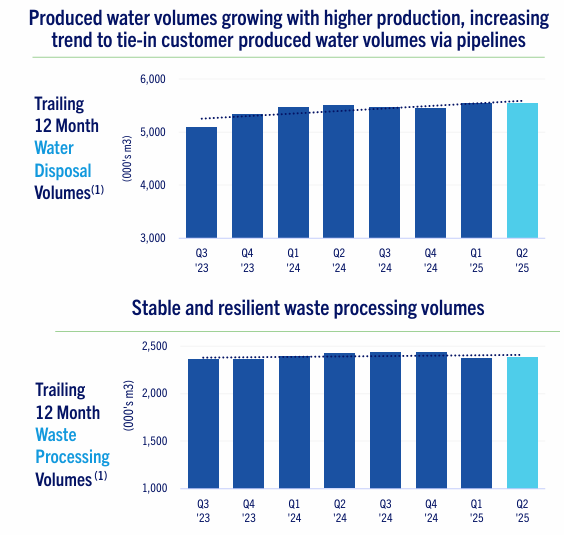

Volume growth from existing operations. In the long term should be around GDP growth.

New organic growth: brownfield and greenfield expansion. Brownfield projects are less risky than greenfield but the management hopes to get ~20% post tax IRR in new organic projects. Those projects are signed initially for a 10 year contract but they’re very likely to sign an expansion for another decade. In this second contract we can assume the unit economics are even better for Secure Waste because the capex is already spent.

Pricing power. Critical infrastructure network that brings physical quasi-monopoly for the owners of the asset. Companies who produce waste cannot skip processing them. Therefore Secure Waste offers a highly critical service. It’s likely that waste expenses are not a big part of the expenses of the customer. (but you cannot cut them to zero) so we can assume Secure has pricing power due to these reasons.

M&A. The management team is looking to buy companies within waste management space. Around 10-20% of the industry belongs to pop and moms owners that normally sells around 5x EBITDA. If you can buy at 5x EBITDA, there is implicit a 20% return. Your IRR will be this return plus any organic growth. There is potential to roll-up the industry at a very attractive valuation. Once you acquire the target, the synergies are likely to appear. You can reduce transportation cost (the biggest cost in this industry), optimize facilities and reduce price paid.

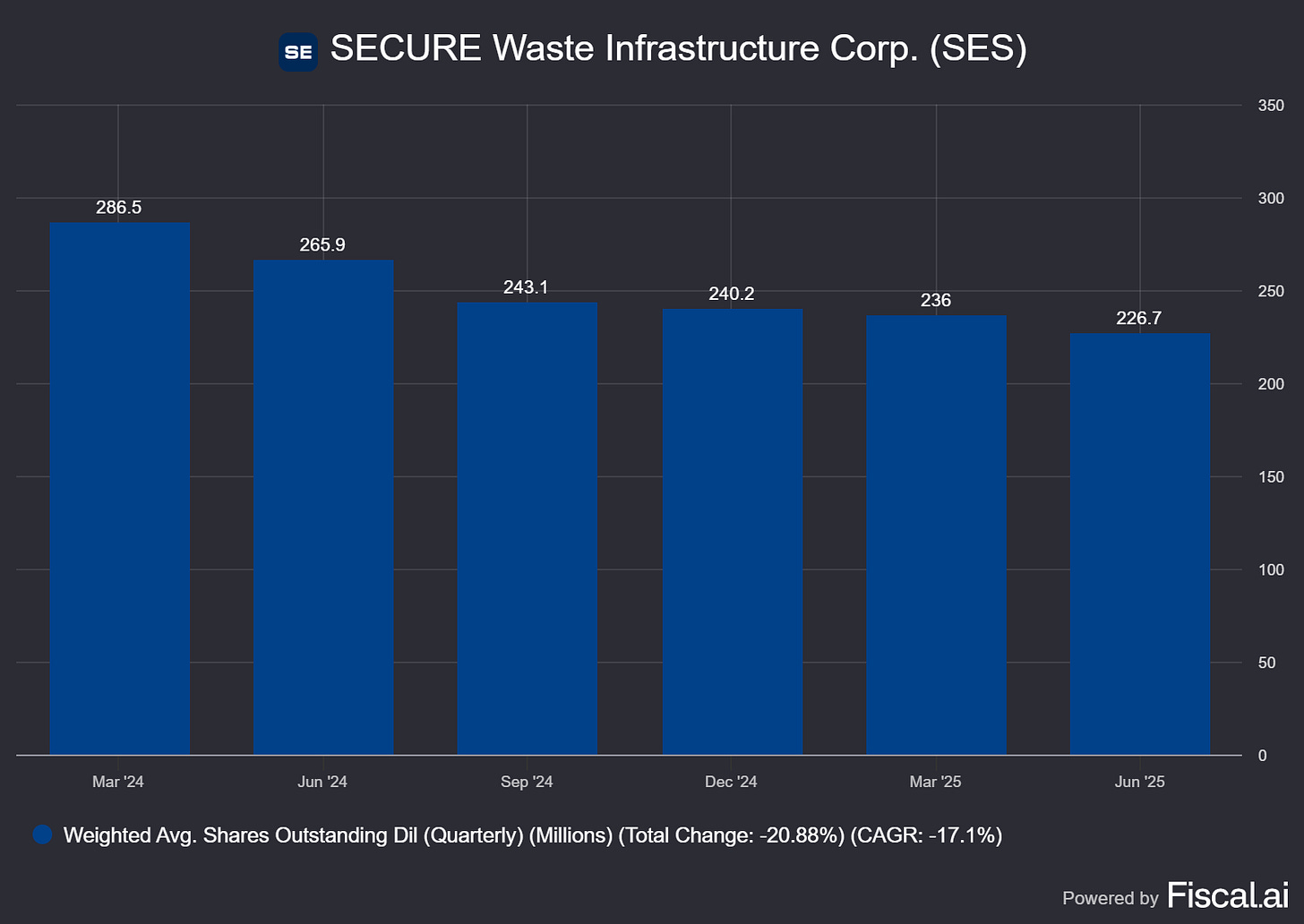

Beyond growth opportunities, shareholders will benefit from buybacks and dividends as well. At $16,2 per share is trading at 17,4% buyback yield LTM and 2,4% dividend yield. Therefore if we subtract current debt paydown yield, the shareholder yield is 13,6% TTM. We can expect this trend to continue meanwhile the valuation stays at the current levels. The management and the board seems to be really supportive with the buybacks. Their operations provide stable cash flows to continue the huge buybacks on’going.

Operations

The company has two segments: waste management and energy infrastructure.

Waste management owns a network of waste processing facilities, industrial landfills, metal recycling facilities, and field solutions for handling hazardous and non-hazardous waste. The services included are the treatment of waste water, hazardous and non-hazardous waste collection, industrial landfills, metal recycling and specialty chemical formulation. In summary: Secure operates in the waste sector in different market niches.

Our infrastructure supports reoccurring waste streams and is built to perform across cycles. We provide critical regulatory-driven services through this infrastructure, helping our customers meet environmental obligations while ensuring safe, compliant, waste handling.

Energy segment includes the operations from Secure to customers engaging in the transportation, optimization and storage of crude oil from pipelines. Also, Secure is involved in oil trade. It makes sense to have this low risk business associated with pipelines. Financial statements are not clear at first glance due to the oil trade operations though. I will not consider this revenue as core revenue going forward.

As can be seen below, Secure has a strong presence in Alberta, with less exposure in other regions of Canada and North Dakota in the United States. The company specializes in waste treatment facilities, which are very stable and, to a certain extent, protected from economic crises. Industrial landfills are highly valuable and scarce assets, as supply is severely limited by regulations. This collection of assets (80 locations) creates a critical infrastructure system with 80% recurring cash flows. Waste treatment must be carried out regardless of the economic cycle.

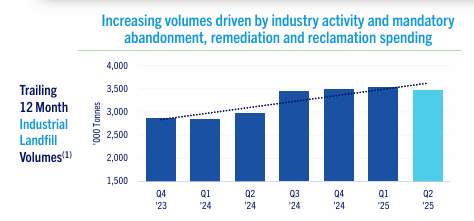

One of the company's strengths is the recurring nature of its business. 80% of operations are linked to continuous volumes, and only 20% of the total volume is related to drilling and new volumes. The volume is stable, as waste is generated on a daily basis. The volume can be stable during less intense periods, as companies will continue to operate anyway, and will increase during more intense periods. However, volume growth may not be very exciting (around GDP growth most of the time). On the other hand, the pricing power in this business is very strong. Secure operates a network of critical assets that creates a geographic monopoly. Transportation costs are the main alternative cost for switching waste management providers, and customers are very likely to prefer paying a higher price, as these fees are a small part of their budget, rather than switching providers. Any waste management problem will result in a higher cost compared to the price increase. This recurring volume provides stable cash flows to the company. The combination of highly skilled capital allocation management and a highly liquid business is an attractive setup for investors. The image below shows an example of the recurrence of the volume processed.

I like to think of Secure Waste as a proxy company of Linde PLC. Secure can build a waste processing plant next to the customer's facilities or in a strategic geophysical location. This plant is very complex and involves the collection and unloading of waste until its disposal. For this reason, not everyone can build their own facilities. It requires operational experience, compliance with highly complex regulatory requirements, and a significant capital investment. A facility such as the one shown below is 1) durable, 2) creates local monopolies, 3) generates a high internal rate of return (IRR), and 4) has pricing power. In addition, Secure only builds facilities with a signed contract (in which the company is protected against inflation) and it is very likely that the customer will renew the contract over time. These contracts (especially renewals) are very profitable for Secure, as they achieve customer growth and profitability is guaranteed by contract.

Secure will enjoy one tailwind which will drive volume growth: the complexity of the waste management process is increasing over time. Therefore, more companies are outsourcing this process, benefitting companies like Secure. This increasing complexity brings more regulation as well. More regulation brings (most of the time) more complexity to the matter.

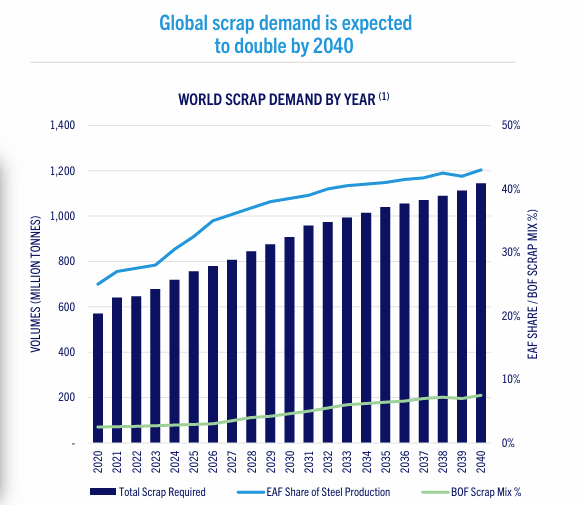

Secure also has exposure to the scrap space. The management team has developed this part of the business recently as they saw a great opportunity to deploy cash into M&A in this space. I really like this approach as the management team is willing to take small bets that it makes sense with the core business. Secure has created a network of facilities that aggregate and process scrap mental. At the moment they own 12 sites along West Canada but based on the latest earning call, I think Secure is looking forward to integrate more sites through M&A.

Those scraps will be sold to another company that will use it afterwards to manufacture more products. There is an increasing tendency for pushing a circular economy and those assets will provide Secure exposure to this trend. In order to have a competitive advantage in this space, Secure is building/acquiring facilities close to the customer and building a railcar system to move more volume quicker.

Secure also owns important highly value assets such as industrial landfills. Those lands are very scarce due to: i) geologically challenging to find suitable locations ii) it’s very difficult to obtain required permits (dealing with governments it’s not an easy process) and iii) high capital investment. Those lands cost a lot of money at the beginning (low beginning IRR) but over time the value of those lands will be higher and also unlock competitive advantages to the company. Not in my backyard effect is very important for Secure and owning those assets provide stability and a relevant position in the future. ESG trend is there and it will continue as we need to decrease our environmental impact.

Capital allocation

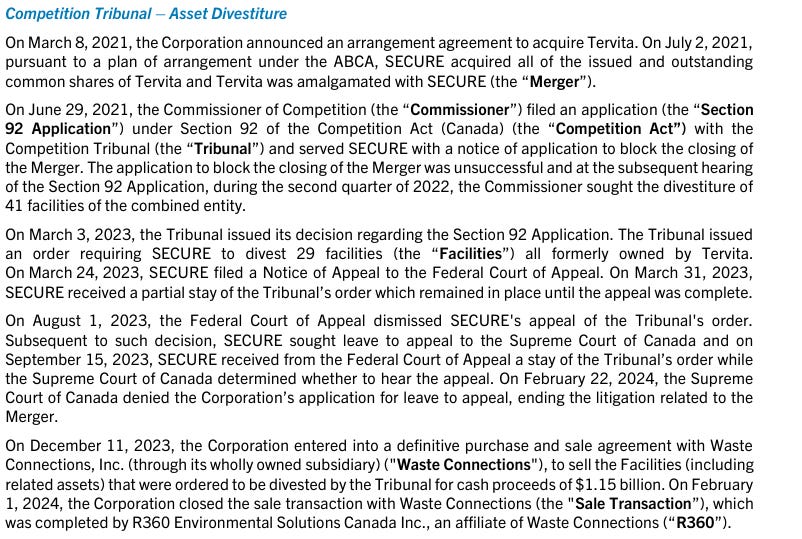

The investment thesis cannot be understood without the capital allocation scheme of today. In order to understood it, we need to check one M&A acquisition from 2021. They acquired Tervita, its former main competitor back in 2021, and they got 70% market share in Alberta region. Unfortunately, Secure was forced to sell ⅓ of the assets acquired by the authorities. Secure was blocked to own all assets bought from Trevita due to the Canadian Tribunal found the acquisition allowed Secure to being a very dominant position. Some worries from the Tribunal were: pricing power, geographical monopoly, low risk of self-supply from companies which generates waste, high barriers to entry and no demanding competition. It sounds a really attractive investment thesis, isn’t?

Even tough the situation was difficult, they managed to sell them a ⅔ of the original acquisition price to Waste Connections in 2023. This distress sell was very smart. Also, during the period they owned those assets, they generated enough cash to offset the ⅓ remaining of the price paid. At the end, they got ⅔ of the assets for free. With the money collected from the distress sale, they pay down 33% of the debt and buy back 22% of the outstanding shares since then.

They paid $526M using their own stock plus the assumption of debt. This price means around 6x EBITDA without including any synergy impact. They sold the same assets for $1.15B or 7x EBITDA. Meanwhile they own the assets they generated $519 and $548M in EBITDA for 2022 and 2023, way higher than forecasted by the management as the synergies were better than expected.

The management and the board are true believers of the undervaluation of the company and for this reason they are buying back stock ~12% per quarter. We can consider them as a very opportunistic use of the cash and we can expect the buybacks will stop if the company reaches a valuation multiple similar to the industry.

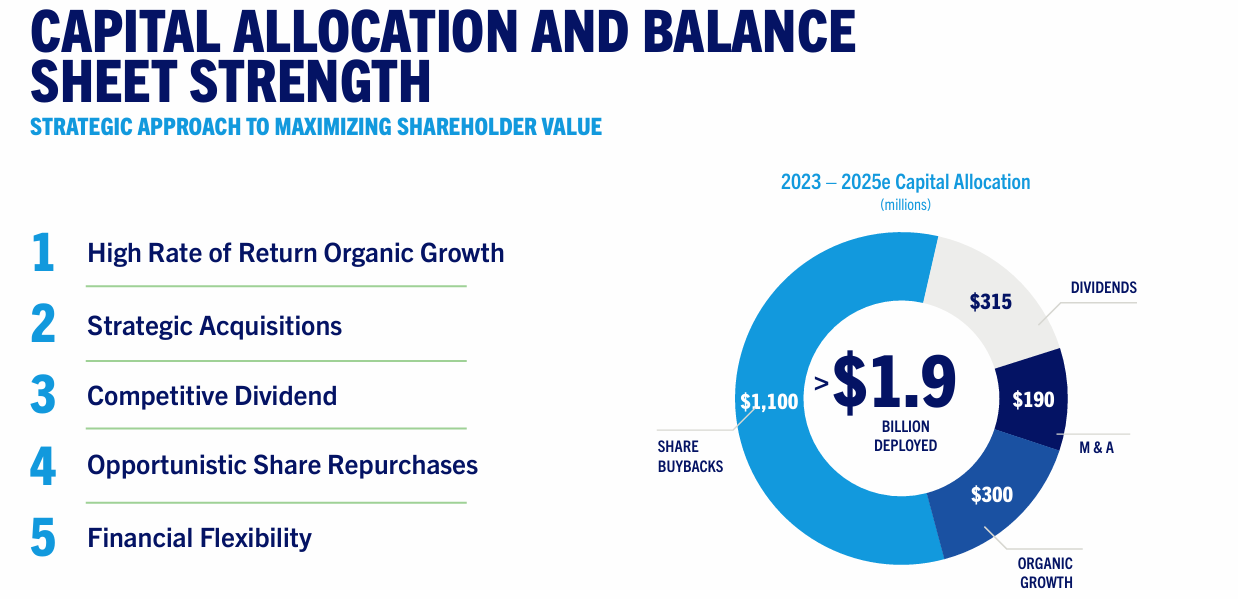

Their strategic approach to maximize shareholder value is:

High rate of return organic growth. Brief reminder that whenever they invest into organic projects is because they expect to get 20% post tax IRR in the first contract.

In 2025 they’re targeting a $125 million organic growth capital. They claim that over 90% of which is directed toward WM projects. According to management organic growth return expectations, this investment should bring around $90 millions extra.

Strategic acquisitions. They want to roll-up the industry to expand its waste management segment. They are finding more deals within the metal recycling space. We can expect from the management team to buy companies paying around 5x EBITDA. If they can source any type of synergies, this reduced cost will lower the multiple paid.

Competitive dividend. Not an exciting use of cash at the current set-up but I guess they do it to attract money flow from passive investing and recompensate insider owners.

Opportunistic buybacks. By far the most exciting shareholder compensation avenue at the current valuation. Since 2023, $1.9 of capital has been deployed and $1,1B of that has been used for buybacks. We can consider buybacks are highly likely to be constant and for shareholders it will be better that this low valuation persists overtime to give space to Secure to buy back more stock. In the latest tender offer launched by the company to accelerate share buybacks, the tender offer was undersubscribed. This highlight the current shareholder confidence into company’s future.

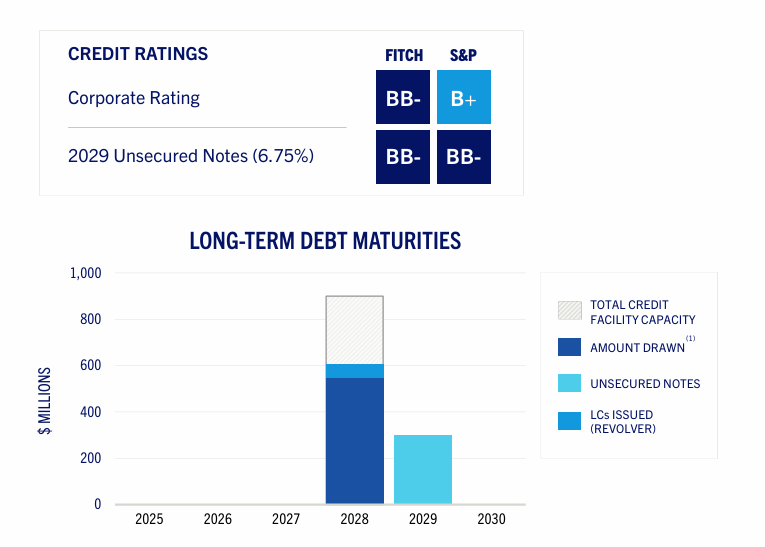

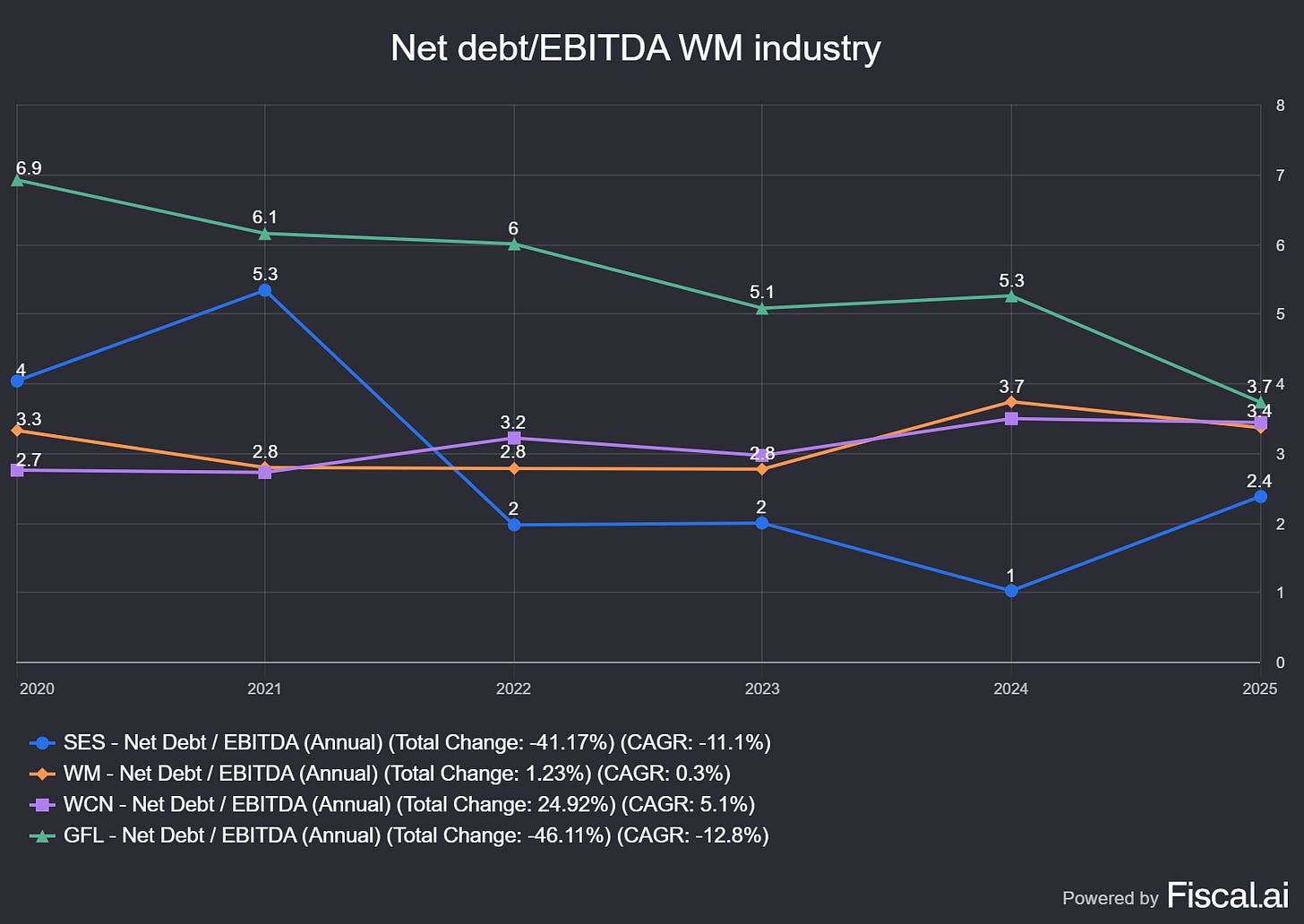

Financial flexibility. They paid down a big chunk of the debt and now the company has a very robust balance sheet at the moment: 2,1x total debt to EBITDA. The stability of cash flows seems to be in a safe position as 70% of the customer revenue is investment grade. They don’t have any maturity until 2028.

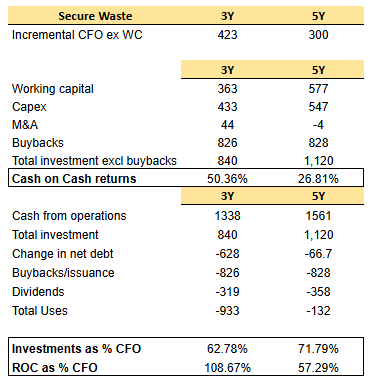

If we analyze the funds used and the capital allocation scheme from 2023 to 2025 we can see:

~58% of the funds has been used for buybacks

~16% to organic growth projects

~17% to dividends

~10% to M&A

All those investments has been mainly funded by the cash generated by the business itself plus a prudent use of leverage.

If we analyze cash on cash returns, it’s clear Secure enjoys a highly profitable operations. Those real physical assets which are critical for our economy shows trash means cash.

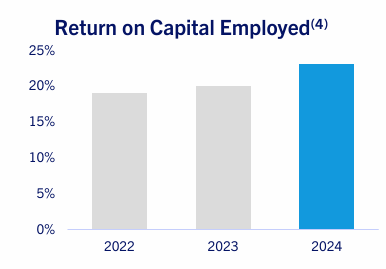

Also, ROCE is increasing over time, moving towards to 25%. Once those organic investments matures, this metric should be higher as a consequence. Besides that, the facilities are operating at 60-65% capacity, therefore Secure has capacity to operate more volumes without incremental capex needed, which will lead to improving ROCEs.

Financial development

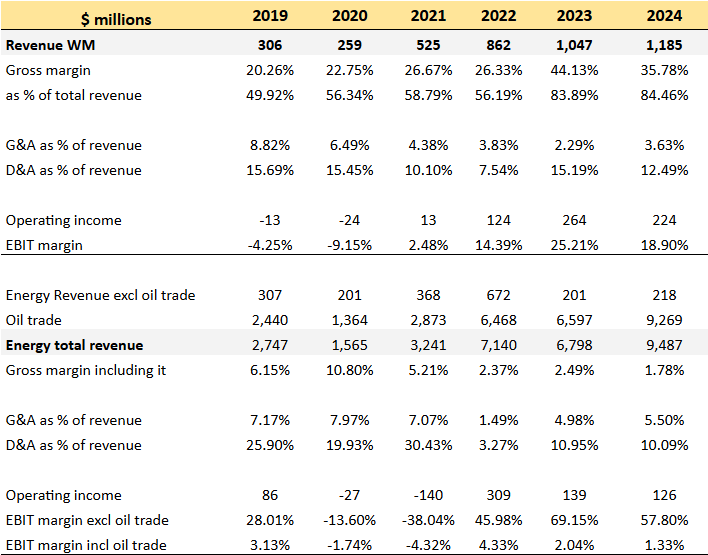

First of all, financial statements are not clear at first glance for the company. This is because 1) Trevita acquisition and divesture 2) oil trade. Regarding the latest, Secure is involved in the trading of oil, which it’s a very low margin activity. Secure owns the pipelines and offering this service, therefore the risk related to this part of the Energy segment is very low. The company claims customers benefits from this activity due to transportation and go to market value-add activities. Due to these reasons, any financial metric from P&L can be seen as erratic. In order to separate noise from business reality, I’ll exclude oil trade from my analysis.

There are two segments with different unit economics. You can see here the reality is way different than at the surface level. Waste management segment enjoy a very healthy margins, with gross margin being close to 36% and EBIT margin almost at 20%. The pivot of the company from being an energy company to waste management company can be observed as waste management segment comprises 85% of total revenue. In the other side, energy segment is very messy. If we exclude oil trade, margins are very solid too. Pipeline, as waste processing facilities, are very unique sticky assets. Eventually this segment will mean a very low portion of the revenue but it’s worthy to notice how profitable are those assets.

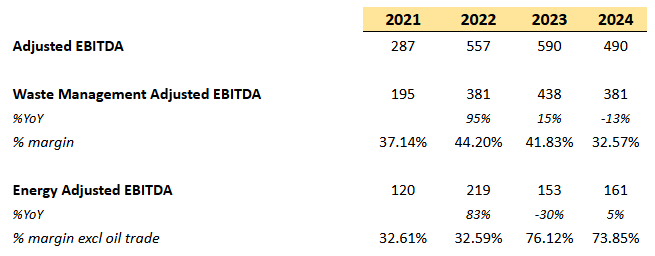

If we analyze adjusted EBITDA, we can see waste management segment enjoys a very good margin as a result of its scarcity and criticality to customer’s operations. I won’t expect much improvement from the current margin as Secure enjoys similar profitability to peers.

Brief note: Adjusted EBITDA by segment does not include head office costs, so if both segments are added together, the total does not match the reported adjusted EBITDA.EBITDA is a very scary metric for some investors due to bad practices from some companies but, in my opinion, instead of hate this metric I think it’s better to double check its conversion to actual cash flows. If the company translates a big chuck of its EBITDA to FCF, then it’s a well use metric. In Secure Waste case, the conversion is nearby 60% every year. z

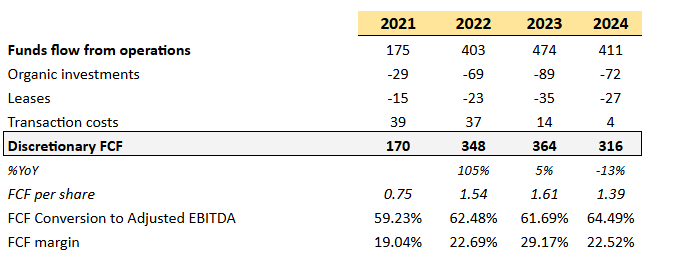

The company follows a non GAAP FCF metric but whose calculation seems fair to me. From FFO (a metric used by real estate akin assets) they reduce just organic growth initiatives, leasing costs and transaction costs. The FCF margin you can see in the picture below is using discretionary FCF/revenue excluding oil trading.

Don't be afraid of using this FCF metric in this case. The FCF margin using CFO post working capital minus D&A and leasing costs, give us the same FCF margin.

This metric shows really well how profitable are the assets from the company. Secure has a huge footprint in Alberta, one of the region where the energy sector has a deep relevance to the country’s economy, therefore the current assets will keep receiving volume (trash) from those kind of companies.

The cash generation seems to be solid, but is the company able to reinvest those funds? In average, Secure has reinvest around 60% of the cash flow generated. In addition, the ROIIC has been around 33% since Secure pivot to waste management operations. Therefore, the value added has been 20% without including buyback effects. For a boring business like Secure, this result is outstanding.

This marvelous shareholder value creation has been made without being exposed to significant leverage. Actually, Secure has been the company of the industry with the lowest leverage ratio in the last 3 years. Buybacks and organic growth investments has been founded by own cash generation.

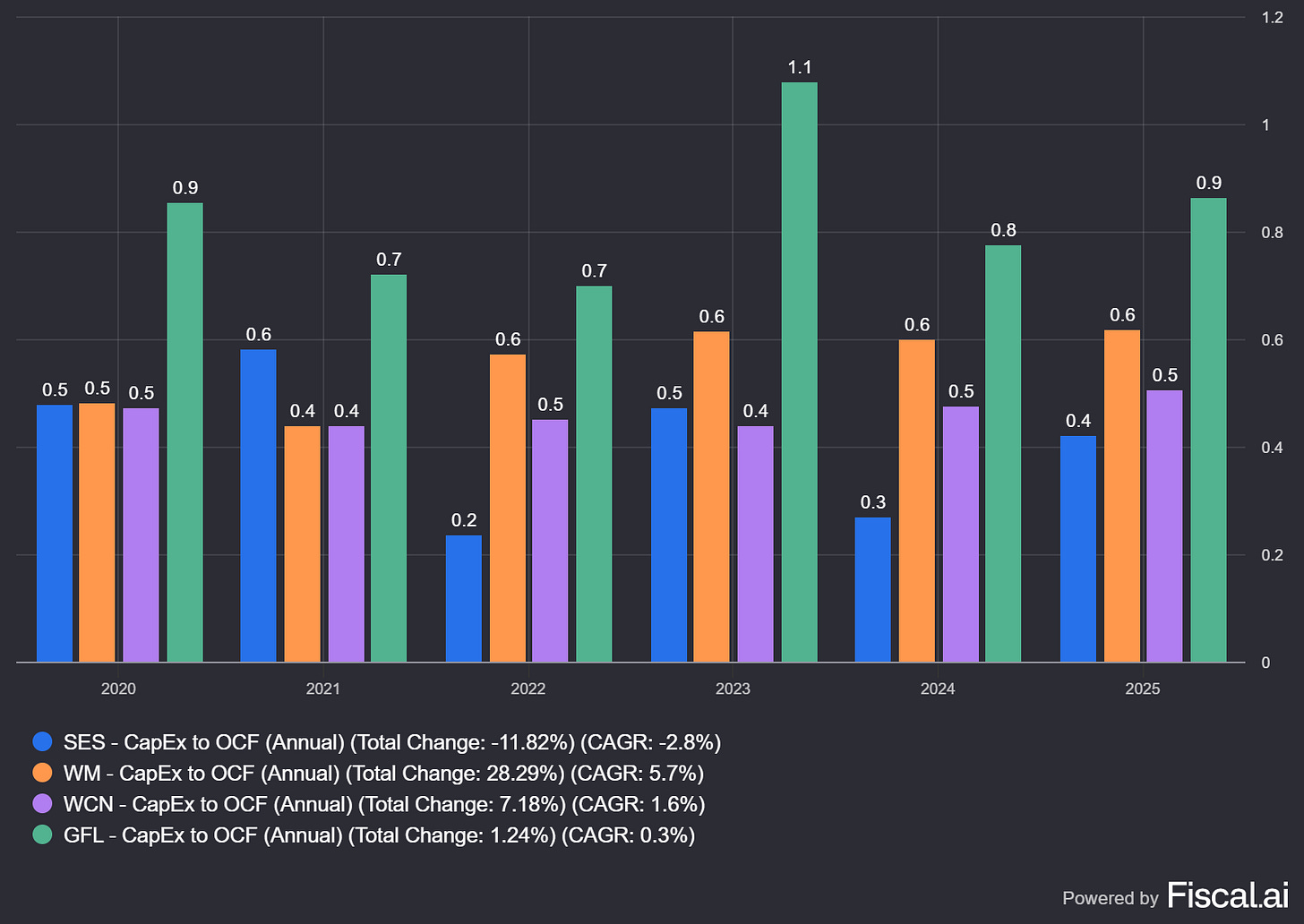

The current capex intensity is 32% of CFO in the last 3 years. This percentage is higher in the last 5. I presume almost all this capex spend is growth capex. However, this is just my thought, the management do not share any split about maintenance and growth capex. If I compare capex to CFO ratio between Secure and its peers, Secure is the company with the lowest ratio.

Lastly, even tough Secure operates facilities and physical assets, the impact of NWC is lower than expected. In 2019 NWC was 3,4% of sales but in 2024 it was 0,9% of net sales. Secure has been growing but the NWC has been decreasing, improving cash conversion. The cash conversion is strong and it will boost cash available to buybacks or growth investments.

Management

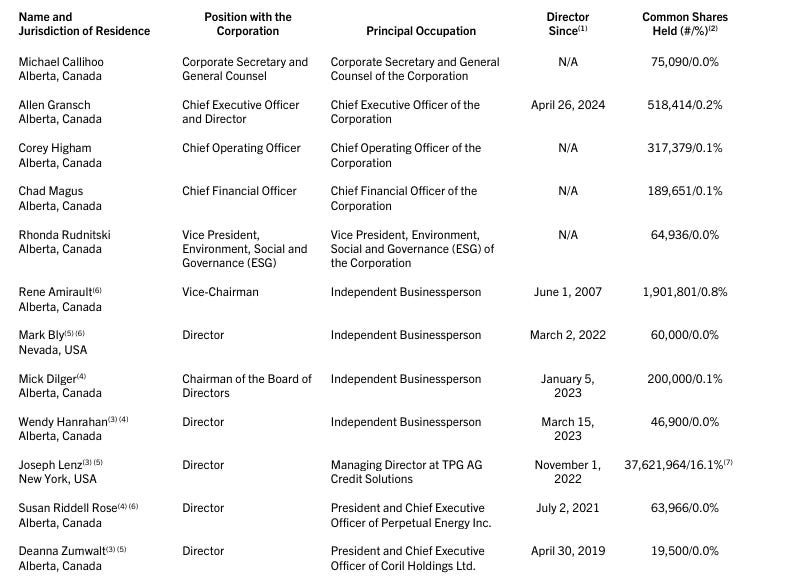

This is the management and board composition. Although at first glance one can think it’s a very new management team, the reality is that Allen Gransch, the current CEO, has been working in the company since 2007.

Allen Gransch was appointed President in November 2022 and added CEO to his title in May 2024. Allen has been with SECURE since September 2007 in various leadership roles, serving most recently as the Chief Operating Officer (COO) of both Midstream Infrastructure and Environmental Solutions. Prior to his role as COO, Allen was Executive Vice President and Chief Financial Officer, and EVP, Corporate Development.

Chad Magus, the CFO, has been employed since 2014 and has handled the CFO role since 2017. Prior to joining SECURE, Chad spent over 10 years with an oil and gas exploration and production company in a variety of finance, accounting and financial reporting roles. Before that, he was a senior accountant with KPMG LLP. Chad is a Chartered Accountant and holds a Bachelor of Commerce degree from the University of Saskatchewan.

Corey Higham is the COO since November 2022. Corey has been with SECURE since July 2007 in various leadership roles within the corporation. Since May 2020, Corey held the position of SVP of Midstream Infrastructure Operations. During that time his responsibilities included facility operations, corporate and field sales, engineering and construction, and health, safety, and regulatory affairs.

Prior to SECURE, Corey held various roles at Tervita Corporation (2004-2007) and worked for a private engineering consulting company from 1998 to 2004. Corey is a registered Professional Geoscientist and holds a Masters of Engineering from the University of Calgary

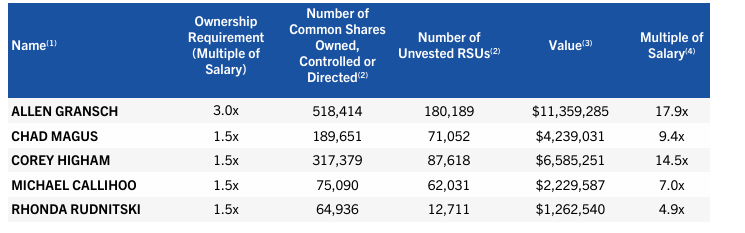

This is the management who did the Tervita M&A operation and wants to focus Secure on the waste management business. The main inconvenience is that they lack owning shares. When analyzing their capital allocation plan, this does not appear to be an issue, as they are clearly focused on creating value per share for shareholders.

The main shareholder is TPG AG Credit Solutions with ~17% of the outstanding shares. This division is part of TPG Angelo Gordon, which it’s a global credit and real estate market for 35 years. I’m not familiar with this investment firm but I like they’re focused on protecting capital, generating above-average returns with low volatility over a long period of time. As I said, I’m not familiar with this firm but it seems to be a shareholder that will allow the management to operate and think long term.

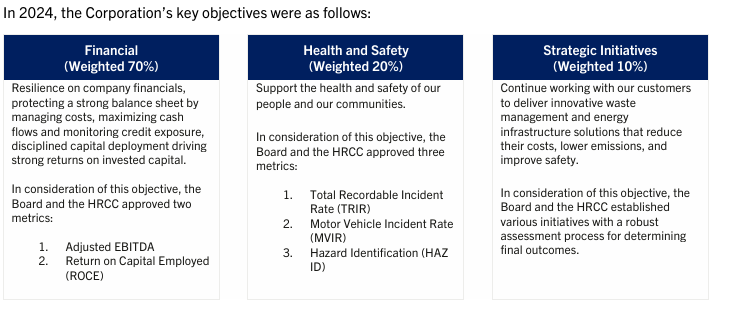

Lastly, the management’s remuneration structure is:

Base salary established based on a benchmarkt with peers selected.

Short term incentives. 80-100% weighted and is based on Financial, Safety and Strategy metrics. Up to 20% additional based on individual contributions towards Secure’s annual operating plan. Regarding the incentives, I like the metrics picked are related to long term development of the business. Including ROCE makes management wonder if any cash used is dilutive for the returns.

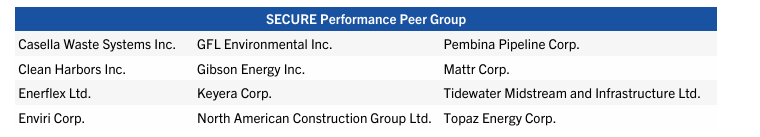

Long term incentives. PSUs (Performance Stock units; shares due to performance) are weighted 50-75% and are based on Financial and ESG metrics. The payout can be 0 200%. RSUs (Restricted Stock units; shares due years worked in the company) to are weighted 25-50% and pay out based on the value of the share price at the time of vesting. 50% of PSUs are granted based on relative total shareholder return metric. It measures TSR from Secure and TSR from a performance peer group.

The rest of PSUs are granted using Discretionary FCF/share comparing the average of 3-year annual results against budget. This might motivates management to announce weak guidance in order to increase this part of the remuneration system. However, I like they establish FCF/share. Discretionary FCF is a non-GAAP metric from the company but its calculation seems very fair to me: FFO - Organic investments - Leases - Transaction costs. A green flag in my opinion.

This remuneration structure helps somehow to reduce the risk of low insider ownership. Between 80-90% of the total remuneration package is incentive related. Besides that, there is a ownership requirement. This requirement is calculated summing up the number of common shares owned plus the number of unvested RSUs. Also, the CEO is mandate to hold those shares at least three years.

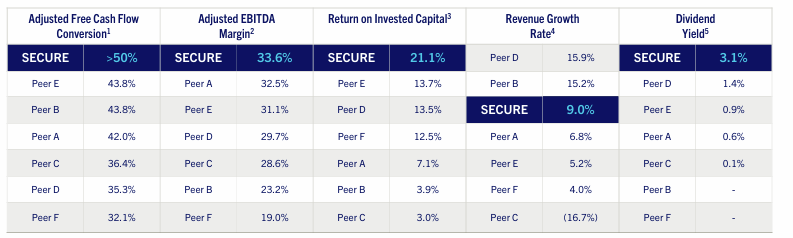

Peers

Secure ranks the best company in almost all the financial metrics selected except revenue growth rate. In my opinion, it’s very interesting to see how the ROIC is the best one in the industry. It might be explained as Secure owns quality assets in a quasi-geophysical monopoly that brings pricing power and financial stability to Secure. At the current valuation, shareholders do not need a high revenue growth rate at the moment. With a shareholder yield current to 15%, you don’t need a high growth to make the investment work.

Waste Connections and Waste Management have been two amazing investments for shareholders with 17% TSR and 19% TSR in the last 5 years respectively. Waste management industry offers a highly critical service with tailwinds supporting the outsourcing of those services to third parties with deep expertise. If there is more than one winner you can think the industry itself is a long term winner.

Besides that, the industry is consolidating into a few big players because the landfills (one of the most relevant assets) are very scarce. It seems all the players from this industry have a very rational approach to pricing power and competition. Price increases are at least the same as the inflation.

Advantages and risks

The company has very valuable and unique assets that are in short supply. This scarcity translates into durability and pricing power. Waste management services are here to stay.

I consider management to be an advantage, as they have a very good understanding of capital allocation. With this valuable skill, in addition to the steady cash flow from the core business, the result for shareholders can be really good.

I believe there are switching costs in this business. If you build a plant next to your facilities with Secure, I don't think it makes sense to switch waste management providers. You will lose your investment, and you need a reliable partner in these matters, where reputation could be at risk in the event of malpractice.

Returns could be lower when repurchase performance declines due to stock revaluation or lower cash generation. This is an unlikely risk at this point, but the long-term thesis cannot be sustained solely by current buyback performance.

The company may end up needing more investment in organic growth to maintain cash generation and revenue growth, as growth at current facilities is worse than expected. This will result in less free cash flow available for buybacks. In addition, if growth at current facilities is lower, ROIC and ROIIC will be negatively affected.

The current qualified management team could change at any time. In addition, there could be an acquisition by WM or WCN, and shareholders could be forced to sell.

Valuation

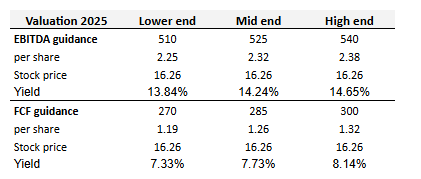

The valuation model is quite simple here. I’ll use the current 2025 guidance provided by the management team. Using three points in the guidance, we can see the attractive valuation of Secure at first glance. It’s worthy to notice that the buyback effect is included here trough using both financial metrics at per share basis. 7% yield at the worst case scenario this year it does not sounds bad to me.

The current low-attractive valuation do not force us to make a very detailed long-term valuation scenario but I think it’s feasible to see an EBITDA growth of 10% (revenue growth of ~8% plus operating leverage) plus dividends and buybacks. In case a re-rate happens, the buybacks might have a lower impact.

Disclaimer

This article is not and does not intend to be a recommendation to buy and/or sell. Each person should do their own research before making an investment decision.

Great detailed write up!

Great write-up! This company offers a high confidence, strong return profile for investors for years to come.